Should American Progressives Be Calling for a “Public Option” in Banking?

November 30, 2011 | Economics & Trade Politics and Policy Progressive Political Commentary

Proposals for a public banking option are almost unheard of in the U.S., where free-market orthodoxy has, throughout most of our history, held sway over collective approaches to the provision of public and private goods and services. Nonetheless, the concept deserves serious consideration based on the evidence in at least a couple of areas. First, there is the striking success of this model in other advanced and advancing economies for providing and directing lower-cost, long-term capital essential for growth. And second, while better financial sector regulation, oversight, and enforcement might mitigate the worst excesses of an opaque multinational private banking system, it remains doubtful that the resources of regulators can ever match those of the private banking system to circumvent regulations and evade the consequences of wrongdoing. It is now widely understood that the private global banking and financial system has failed to serve the “real” economy, or what we often call, “Main Street.” This is not just the case in the U.S. Europe’s problems, while largely due to an ill-designed monetary union and the high sovereign debt of certain member countries, has been exacerbated by the same short-term-profit-driven, casino approach that has characterized the U.S. financial sector. Perhaps the time has come to consider another model, one that treats banking and finance more like a public utility. A public bank would not have to be beholden to shareholders demanding a 20% annual return. It could circumvent incentives that induce management to take extraordinary risks (cognizant that in the worst-case

Read More...

Why the NAFTA-style Free Trade Agreement Will Fail to Benefit Colombia

October 21, 2011 | Economics & Trade

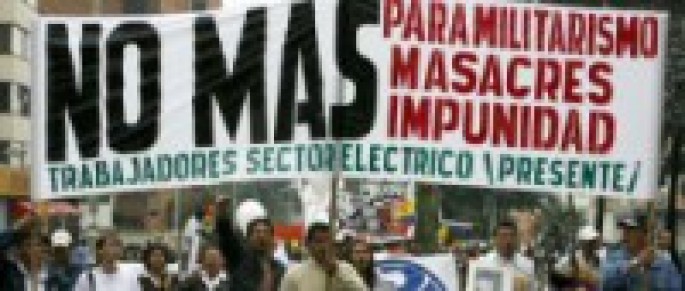

Despite evidence of limited economic welfare benefits and significant social costs, Latin American countries have been signing and ratifying trade treaties with the United States since the early 1990s. This week, the long-stalled treaties with Colombia and Panama were ratified by the U.S. congress and signed by the President. Like other trade treaties, these were based on the same template that has been the basis for U.S. trade policy since NAFTA. In the case of the Colombia Free Trade Agreement (Colombia FTA), promises from the government of President Juan Manuel Santos to better protect trade unionists pressured enough reluctant Democrats to vote in favor of the agreement. Over 4,000 trade unionists have been murdered in Colombia in the past 20 years, mostly by right-wing paramilitaries with links to the government, making Colombia the most dangerous country in the world to support collective bargaining rights. Colombian labor union leaders have rejected government claims that human rights and trade unionist protection has improved, denigrating symbolic gestures aimed at securing U.S. ratification of the agreement, which they rightly claim will help multinational companies over Colombian workers. In addition to doubts that the Colombian government will live up to its promises vis-à-vis the trade unionists, the gains from trade that Colombia can expect once the agreement is in force are ambiguous at best. When the gains to some sectors (e.g. cut flowers, leather goods, seafood, textiles, certain services) are measured against the losses to other sectors (e.g. rice, corn, poultry, communications technology), along with fiscal

Read More...

JOBS, JOBS, JOBS: A Primer for Politicians who flunked ECON 101

November 9, 2010 | Economics & Trade Politics and Policy

Workers without jobs can’t provide adequately for the basic needs of their families. The unemployment crisis is damaging families and contributing to a multitude of economic and social ills, including: • We now have the highest poverty rate for working-age people between 18 and 64 – 12.9% in 2009 – since 1965. Today, 43.6 million Americans are living in poverty, 19 million of whom are in deep poverty. • Workers who have lost their jobs through no fault of their own often cannot pay mortgages and rent, even when receiving unemployment benefits – that are not equivalent to wages lost. The foreclosure crisis – the outcome of misdeeds of bankers and mortgage brokers – is driving further declines in home values while destroying once vibrant neighborhoods. Joblessness also contributes to increased homelessness, which is not only tragic for families who lose their homes, but is accompanied by broader social harms and increased budget pressures on already strapped local and state governments. • Unemployed workers – along with many who are still employed – are losing employer-based health insurance coverage. In 2009, 50.7 million people – the highest number of uninsured since the Census started collecting the data in 1987 – were without health insurance coverage. Joblessness is increasing pressure on public programs such as Medicaid, while increased use of uncovered emergency services by those with no other option for care is driving further increases in healthcare costs for small businesses and those still fortunate enough to have jobs and healthcare

Read More...

Economic Discontent and Conservatives’ Secret Weapon to Win the Class War

September 25, 2010 | Economics & Trade Politics and Policy

Paul Crist August 13, 2010 Framing the Issue: Class War The white-hot anger on the “Tea Party” political right and the frustration on the political left largely spring from the same fundamental problem: A generation of increasing economic inequality, job insecurity, loss of privilege, and a once optimistic middle class that is under attack and demoralized. Political and mainstream corporate news media leaders avoid the term, but what we are confronting is class warfare in America. The conflict is essentially between the owners of capital, and the owners of labor. The battle lines are less clear than in the past, but this is not the first time in our national history that we’ve been here. In the late 19th and early 20th century, there was only a small middle class relative to the population. The period from 1940 to the 1960’s saw a tremendous growth of a middle class that, while their principal asset remains labor, also holds some capital assets (home equity, stock ownership, and retirement funds) that they fiercely desire to protect. That has helped society’s true economic elites to enlist a substantial subset of the middle class to espouse a capitalist ideology that is largely in opposition to their real economic interests. Asset price bubbles during the past several decades helped to strengthen the ideology of wealth acquisition through capital ownership among middle and working classes, but the bursting of the housing price bubble and consequent financial crisis has been a major blow to the middle class

Read More...

U.S. Trade Policy and Declining Manufacturing: Where do we go from here?

September 25, 2010 | Economics & Trade Politics and Policy

The U.S. economy and the manufacturing sector in particular, face both short-term and long-term challenges. There is debate about whether government can or should play a role in addressing those challenges, and if so, what are the fiscal, industrial, regulatory, and trade policies that would benefit the stakeholders, which essentially include all U.S. citizens in one way or another. I should acknowledge at the outset a bias toward thoughtfully considered government interventions to guide the economy and trade in ways that benefit American workers and allow them to participate in the gains that accrue from their labor. There are economic reasons for my bias that have nothing to do with either socialist or altruistic impulse. That bias in no way means that I favor protectionism or a retreat from global trade, or that government intervention in the economy is always desirable, but there are, I believe, issues and stakeholders that get too little consideration and solutions to structural economic problems that are given short shrift in the name of conservative ideological orthodoxy. There is ample evidence that without adequate and well-designed regulatory intervention in domestic and global markets, capital and political power tends to migrate upward and become concentrated at the top of the economic ladder. We see that phenomenon in country after country, most recently in the U.S. Concentrated wealth becomes problematic when it undermines social cohesion and a sense of shared purpose. The wealth/income gap is at the core of social and political stress and instability in most

Read More...