Should American Progressives Be Calling for a “Public Option” in Banking?

November 30, 2011 | Economics & Trade Politics and Policy Progressive Political Commentary

Proposals for a public banking option are almost unheard of in the U.S., where free-market orthodoxy has, throughout most of our history, held sway over collective approaches to the provision of public and private goods and services. Nonetheless, the concept deserves serious consideration based on the evidence in at least a couple of areas. First, there is the striking success of this model in other advanced and advancing economies for providing and directing lower-cost, long-term capital essential for growth. And second, while better financial sector regulation, oversight, and enforcement might mitigate the worst excesses of an opaque multinational private banking system, it remains doubtful that the resources of regulators can ever match those of the private banking system to circumvent regulations and evade the consequences of wrongdoing. It is now widely understood that the private global banking and financial system has failed to serve the “real” economy, or what we often call, “Main Street.” This is not just the case in the U.S. Europe’s problems, while largely due to an ill-designed monetary union and the high sovereign debt of certain member countries, has been exacerbated by the same short-term-profit-driven, casino approach that has characterized the U.S. financial sector. Perhaps the time has come to consider another model, one that treats banking and finance more like a public utility. A public bank would not have to be beholden to shareholders demanding a 20% annual return. It could circumvent incentives that induce management to take extraordinary risks (cognizant that in the worst-case

Read More...

Why the NAFTA-style Free Trade Agreement Will Fail to Benefit Colombia

October 21, 2011 | Economics & Trade

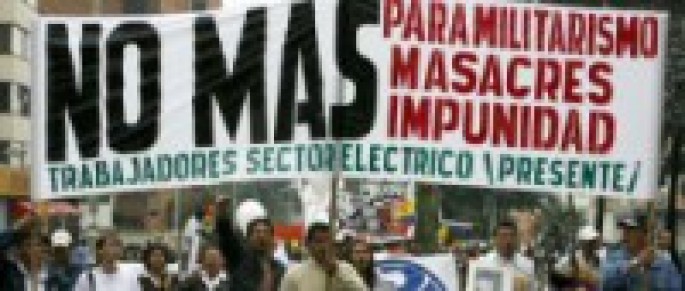

Despite evidence of limited economic welfare benefits and significant social costs, Latin American countries have been signing and ratifying trade treaties with the United States since the early 1990s. This week, the long-stalled treaties with Colombia and Panama were ratified by the U.S. congress and signed by the President. Like other trade treaties, these were based on the same template that has been the basis for U.S. trade policy since NAFTA. In the case of the Colombia Free Trade Agreement (Colombia FTA), promises from the government of President Juan Manuel Santos to better protect trade unionists pressured enough reluctant Democrats to vote in favor of the agreement. Over 4,000 trade unionists have been murdered in Colombia in the past 20 years, mostly by right-wing paramilitaries with links to the government, making Colombia the most dangerous country in the world to support collective bargaining rights. Colombian labor union leaders have rejected government claims that human rights and trade unionist protection has improved, denigrating symbolic gestures aimed at securing U.S. ratification of the agreement, which they rightly claim will help multinational companies over Colombian workers. In addition to doubts that the Colombian government will live up to its promises vis-à-vis the trade unionists, the gains from trade that Colombia can expect once the agreement is in force are ambiguous at best. When the gains to some sectors (e.g. cut flowers, leather goods, seafood, textiles, certain services) are measured against the losses to other sectors (e.g. rice, corn, poultry, communications technology), along with fiscal

Read More...

The U.S. Postal System Crisis: Product of Conservative “Reform”

September 27, 2011 | Politics and Policy

Today, the postal unions representing America's postal workers is organizing a nationwide "Day of Action" to save the US Postal Service (USPS). National news media have reported extensively on the budget crisis facing the USPS, but has done a typically abysmal job of explaining why the crisis exists. These are the facts... Republicans, with the support of the Postmaster, are demanding service cuts and layoffs due to the U.S. Postal Service’s (USPS) inability to fund $5.5 billion due on September 30 to its federal retiree health fund. The expected 100,000 layoffs, in addition to exacerbating an already grim unemployment picture in the U.S., will hit African-Americans and veterans particularly hard – two groups that already have much higher unemployment rates than the national average. But apart from the employment issue, we need to be asking why the USPS is in such dire straits in the first place. The biggest budget problem by far facing the USPS is the mandate placed on it by an outgoing Republican congress in 2006, requiring USPS to pre-fund, over a decade, its employee pensions for 75 years. The USPS is among a handful of employers still offering a defined benefit pension plan that provides real security to retirees after a lifetime of work. The pre-funding requirement, never asked for by the postal unions, was and remains a poison pill for a federally run postal delivery service. No other pension plan, either public or private, is required to pre-fund pension obligations for 75 years into the

Read More...

U.S. Trade Policy and Declining Manufacturing: Where do we go from here?

August 16, 2010 | Economics & Trade

U.S. Trade Policy and Declining Manufacturing: Where do we go from here? By Paul Crist, Aug. 14, 2010 The U.S. economy and the manufacturing sector in particular, face both short-term and long-term challenges. There is debate about whether government can or should play a role in addressing those challenges, and if so, what are the fiscal, industrial, regulatory, and trade policies that would benefit the stakeholders, which essentially include all U.S. citizens in one way or another. I should acknowledge at the outset a bias toward thoughtfully considered government interventions to guide the economy and trade in ways that benefit American workers and allow them to participate in the gains that accrue from their labor. There are economic reasons for my bias that have nothing to do with either socialist or altruistic impulse. That bias in no way means that I favor protectionism or a retreat from global trade, or that government intervention in the economy is always desirable, but there are, I believe, issues and stakeholders that get too little consideration and solutions to structural economic problems that are given short shrift in the name of conservative ideological orthodoxy. There is ample evidence that without adequate and well-designed regulatory intervention in domestic and global markets, capital and political power tends to migrate upward and become concentrated at the top of the economic ladder. We see that phenomenon in country after country, most recently in the U.S. Concentrated wealth becomes problematic when it undermines social cohesion and a sense of

Read More...

Are Bailouts for the Super-Rich Inevitable? Ask Paul Krugman

April 3, 2010 | Paul Crist

Are Bailouts for the Super-Rich Inevitable? Ask Paul Krugman “There’s every reason to believe that this will be the rule from now on: when push comes to shove, no matter who is in power, the financial sector will be bailed out.” Paul Krugman, 3/29/10 “The recovery of big banks not only benefited bankers. It also created huge paydays for hedge fund managers, with the top 25 taking home an average of $1 billion in 2009.” New York Times, 4/1/10 Paul Krugman, the Nobel Prize-winning economist and influential New York Times columnist, says Wall Street institutions have become so big and powerful that they will never be allowed to fail. The only hope he sees is to regulate them thoroughly. He greatly prefers the stricter rules now being offered by Barney Frank in the House to the softer ones coming from Chris Dodd in the Senate. (Neither bill truly tackles the derivatives casino.) Krugman criticizes Senate Republican leaders who portray proposed bank regulations as just another Wall Street bailout. In fact these hypocritical leaders are doing all they can to thwart the Obama administration’s modest reforms and befriend Wall Street, hoping to net some cold, hard political cash from the bankers. Unfortunately, when Krugman says bailouts are inevitable, he’s handing the government haters another round of ammunition. “See, the liberal/pinkos are going to just keep on bailing out Wall Street,” they piously intone. But, why isn’t Krugman calling for an end to all financial bailouts for the wealthy, instead of announcing

Read More...